Recent Articles

Mortgage Rates at 10-Month Lows! Big Opportunity!

Mortgage rates are holding near 10-month lows after early August’s jobs report and mixed inflation data. Here’s what homebuyers and homeowners need to know.

Published on 08/14/2025

Understanding Today's Mortgage Rates: What You Need to Know

Curious about today's mortgage rates? Learn how current mortgage rates affect your monthly payments and the total cost of your home loan. Discover tips for securing the best rates with Mojave River Mortgage and get expert insights on factors influencing mortgage rates today.

Published on 08/11/2025

Rates Just Hit a 10-Month Low!

Mortgage rates just hit their lowest levels since October 2024 following a big shift in the bond market. Here’s why it matters for homebuyers and homeowners.

Published on 08/05/2025

Housing Market Confusing? Here’s Why You’re Hearing Mixed Messages

Confused by the housing market? You're not alone. Here's why the market feels hot and cold at the same time—and what it means for you as a homebuyer.

Published on 07/30/2025

Could Removing Capital Gains Taxes on Home Sales Revive the Housing Market?

A new proposal suggests removing capital gains taxes on primary home sales to boost the housing market. Here’s what it could mean for homeowners and buyers.

Published on 07/23/2025

Game-Changer: Credit Scores Just Got Rewritten

A new credit scoring update could impact who qualifies for a mortgage and at what rate. Learn what this means for first-time buyers and why now is the time to speak with your loan officer.

Published on 07/16/2025

Should You Buy a Home Before Your Divorce is Final? Here’s What to Know

Buying a house before your divorce is finalized? Here’s why it could create legal and financial complications—and how to plan smart.

Published on 07/08/2025

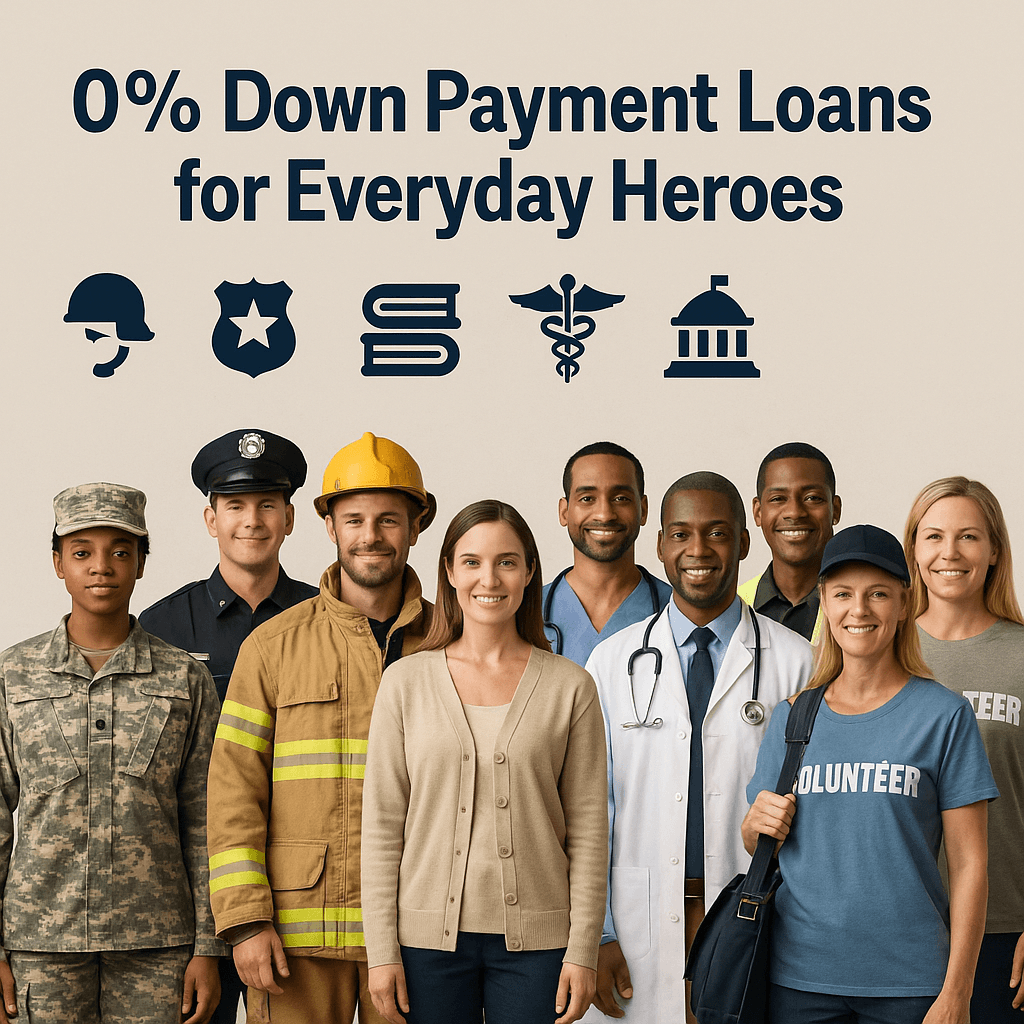

Empowered Down Payment Assistance Programs: Unlock 0% Down Home Loans for Everyday Heroes

Looking for a 0% down payment loan? The Empowered Down Payment Assistance Programs help military personnel, first responders, teachers, healthcare workers, civil servants, and nonprofit staff achieve homeownership with little to no money down.

Published on 06/26/2025

VA Renovation Loan: Buy & Fix Your Home with Zero Down for Veterans

The VA Renovation Loan helps veterans buy or refinance a home and include up to $100K in repairs or upgrades—all with zero down. Perfect for fixing roofs, kitchens, HVAC, or making homes safer and more modern. Learn how this powerful VA loan works, who qualifies, and what you can fix with it.

Published on 06/26/2025

🏢 What Is a Non-Warrantable Condo? | Fannie Mae vs. Freddie Mac Condo Guidelines Explained

Buying a condo? Learn what a non-warrantable condo is, why some condos are ineligible for conventional financing, and how Fannie Mae and Freddie Mac condo guidelines differ. Discover how to navigate HOA issues, investor ratios, and litigation concerns that impact condo loan approvals—and how Mojave River Mortgage can help you secure the right financing, even for non-conforming or portfolio-only condos.

Published on 06/26/2025

Why Homeownership Is Still Worth It—Even Beyond the Finances

From mental health benefits to stronger communities, homeownership offers more than just a return on investment—it offers a better quality of life.

Published on 06/25/2025

Mortgage Rates Aren’t Just About the Fed — Here’s What You Really Need to Know

Mortgage rates held steady this week—but not for the reasons you think. Here’s why working with a loan officer beats doing your own research when timing the market.

Published on 06/20/2025

The Real Estate Rule That Just Got Repealed—And Why It’s a Big Win for Buyers

The National Association of Realtors repealed a rule that kept some listings hidden—thanks in part to pressure from homebuyers, tech platforms, and even the DOJ. Learn how this boosts your home search.

Published on 06/13/2025

Rent vs. Buy in 2025: Is Now the Right Time to Purchase a Home in California?

Is it smarter to rent or buy in 2025? With rising home prices and interest rates hovering around 6.75%, many California buyers are unsure. This guide from Mojave River Mortgage breaks down the real numbers for first-time buyers, move-up homeowners, and real estate investors—showing how homeownership can build equity, reduce taxes, and set you up for long-term wealth, even in today’s market.

Published on 06/10/2025

Asset-Based Home Loans with No Income Documentation | Mojave River Mortgage

Looking for a mortgage without traditional income proof? Our asset-based loan program lets high-net-worth borrowers qualify using liquid assets—no job or income documentation required. With loan amounts up to $4 million, flexible LTVs, and fast closings, Mojave River Mortgage helps you leverage your wealth without selling investments.

Published on 06/10/2025

Delayed Financing in California: Refinance Immediately After Paying Cash for a Home

Bought a home with cash? Refinance right away with Mojave River Mortgage’s Delayed Financing loan—no 6-month wait required. Get liquidity fast.

Published on 06/04/2025

Why Now Might Be the Best Time in Years to Buy a Home (Seriously)

The housing market is shifting—and it's shifting in your favor. Learn why rising inventory, slower sales, and increased negotiating power mean buyers have the upper hand. Don’t miss your window.

Published on 06/04/2025

🧮 Free Mortgage, Down Payment & Affordability Calculator – Instantly Know What You Can Afford!

Easily calculate your home affordability, monthly mortgage payments, and down payment needs with our free interactive Mortgage Calculator from Mojave River Mortgage. This real-time tool helps buyers and investors estimate their buying power and compare loan options to make smarter financial decisions.

Published on 06/03/2025

Introducing the Mojave 2nd: A Flexible Bank Statement Second Mortgage for Self-Employed Borrowers

Explore the Mojave 2nd — a bank statement-based second mortgage designed for self-employed borrowers. No W-2s required, fixed-rate options, up to 80% CLTV, and up to $500K loan amounts.

Published on 06/03/2025

Top Real Estate Crowdfunding Platforms to Raise Capital for Rental Property Investments in 2025

Discover the best real estate crowdfunding platforms for 2025 to raise capital for rental property investments. Compare top tools like Fundrise, CrowdStreet, and SyndicationPro to find the right fit for your investor base and funding goals.

Published on 06/03/2025