Recent Articles

Stronger Data Last Week Caused a Slight Rate Bump

Stronger jobless-claims and durable-goods data from last week pushed the average 30-year fixed slightly higher, but mortgage rates are still near recent lows. Here’s what that means for buyers and homeowners

Published on 12/01/2025

What Today’s Jobs Report Means for Mortgage Rates

Mortgage rates held steady after a mixed jobs report, with unemployment rising and job growth coming in stronger than expected. Learn what this means for homebuyers and what to watch next.

Published on 11/21/2025

50-Year Mortgages? Here’s What You Need to Know

The Trump administration says it’s exploring 50-year mortgage options to help with affordability. Learn what this could mean for homebuyers, monthly payments, and long-term costs.

Published on 11/11/2025

Fannie Mae’s Big Update: You May Qualify Even With a Credit Score Below 620

Fannie Mae’s new credit score policy lets lenders use automated approvals even for borrowers below 620. Here’s what that means for homebuyers who thought they couldn’t qualify.

Published on 11/08/2025

What’s Going On With Mortgage Rates? (Explain-It-to-a-5th-Grader Version)

Mortgage rates dipped, then jumped after the Fed’s cut. A $15B corporate bond sale and stronger economic reports added pressure. Here’s the simple, kid-level way to understand what’s happening and what it means for buyers.

Published on 11/06/2025

Mortgage Rates Jump After the Fed’s Rate Cut — Here’s Why

The Federal Reserve cut rates again, but mortgage rates actually rose. Learn why this happens, what Powell said, and what it means for homebuyers.

Published on 10/29/2025

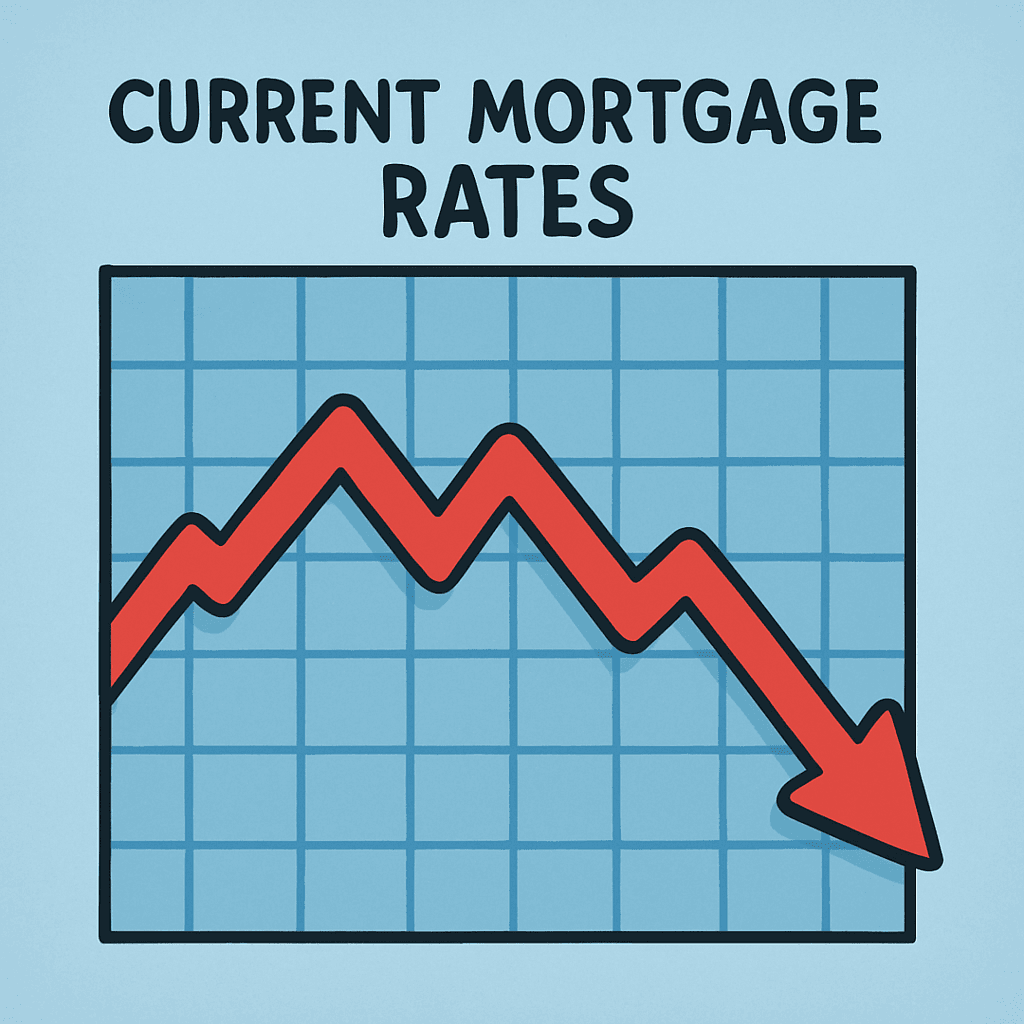

Mortgage Rates Are Falling — What It Means for Homebuyers and Refinancers (October 23, 2025)

Mortgage rates have begun to drop, dropping into the mid-6 % range and sparking renewed interest among both homebuyers and homeowners thinking of refinancing. At Mojave River Mortgage we’re tracking what’s behind the decline, what it means for you, and how to act while conditions remain favorable.

Published on 10/24/2025

Mortgage Rates Hold Near Yearly Lows as Market Awaits Next Data

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Published on 10/22/2025

Gen Z and the Dream of Homeownership: Adapting to a Challenging Market

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Published on 10/15/2025