Recent Articles

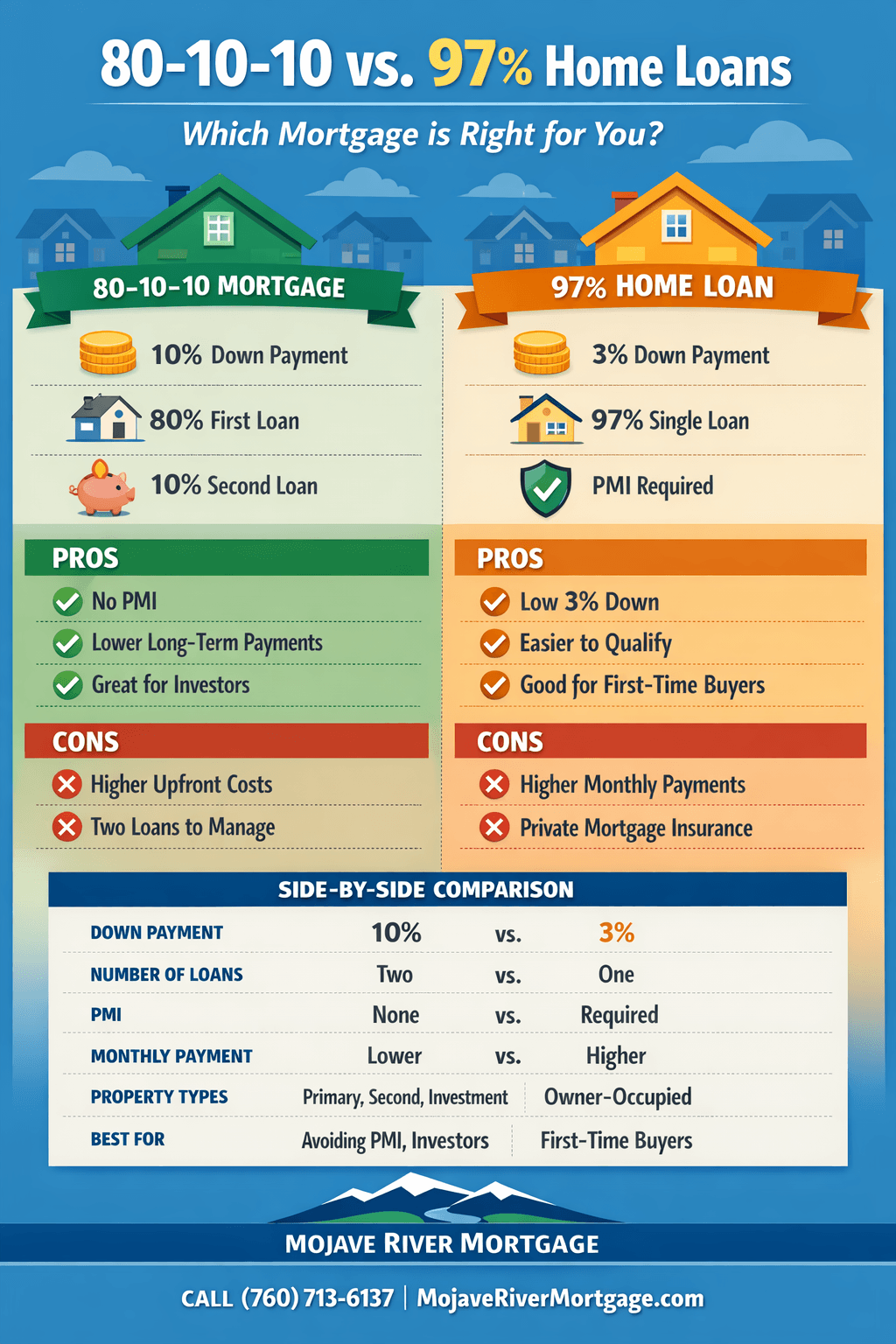

80-10-10 Mortgages vs. Low-Down-Payment Loans: Which Home Loan Is Right for You?

Looking to minimize mortgage insurance or buy with low money down? Mojave River Mortgage offers 80-10-10 piggyback loans, 97% conventional loans, and FHA financing. Compare options and find the right strategy for your home purchase or investment.

Published on 12/18/2025

Inflation Cools in November — What It Means for Mortgage Rates

Inflation slowed in November after peaking earlier this fall. Here’s what that means for mortgage rates and what homebuyers should watch next.

Published on 12/18/2025

Fed Rate Cut (Dec 2025): What It Means for Mortgage Rates & Homebuyers

With the Federal Reserve’s latest rate cut at the December 2025 FOMC meeting, interest rates today have shifted — making refinancing or homebuying more attractive. Here’s what buyers and homeowners should know about the potential impact on mortgage rates and how to take advantage.

Published on 12/10/2025

Current Mortgage Rates: What Homebuyers Should Know in Today’s Market

Mortgage rates continue to shift with economic trends, inflation, and Federal Reserve policy. This guide explains today’s current mortgage rate environment, what affects pricing, and how borrowers can position themselves for better terms when financing a home.

Published on 12/10/2025

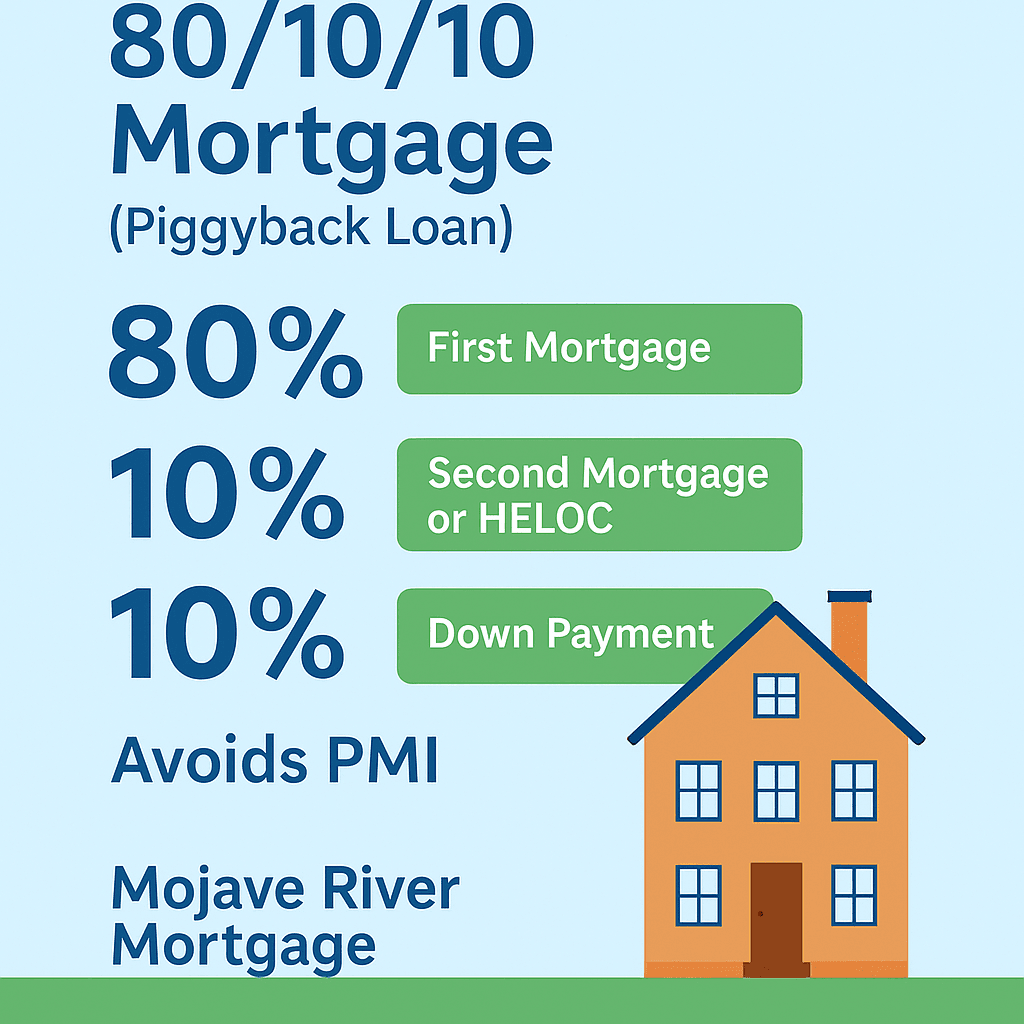

The Complete Guide to the 80/10/10 Mortgage (Piggyback Loan)

The 80/10/10 mortgage is a powerful financing strategy that helps buyers avoid PMI, reduce down payment requirements, and increase affordability. Here’s how the piggyback loan works and when it makes the most financial sense.

Published on 12/10/2025

Fed Cuts Again, But Dot Plot Steers Mortgage Rate Outlook

The Fed cut rates by 0.25% and ended quantitative tightening, but the real story for the average 30-year fixed is in the dot plot and Powell’s comments. Here’s what that means for mortgage rates and homebuyers.

Published on 12/10/2025

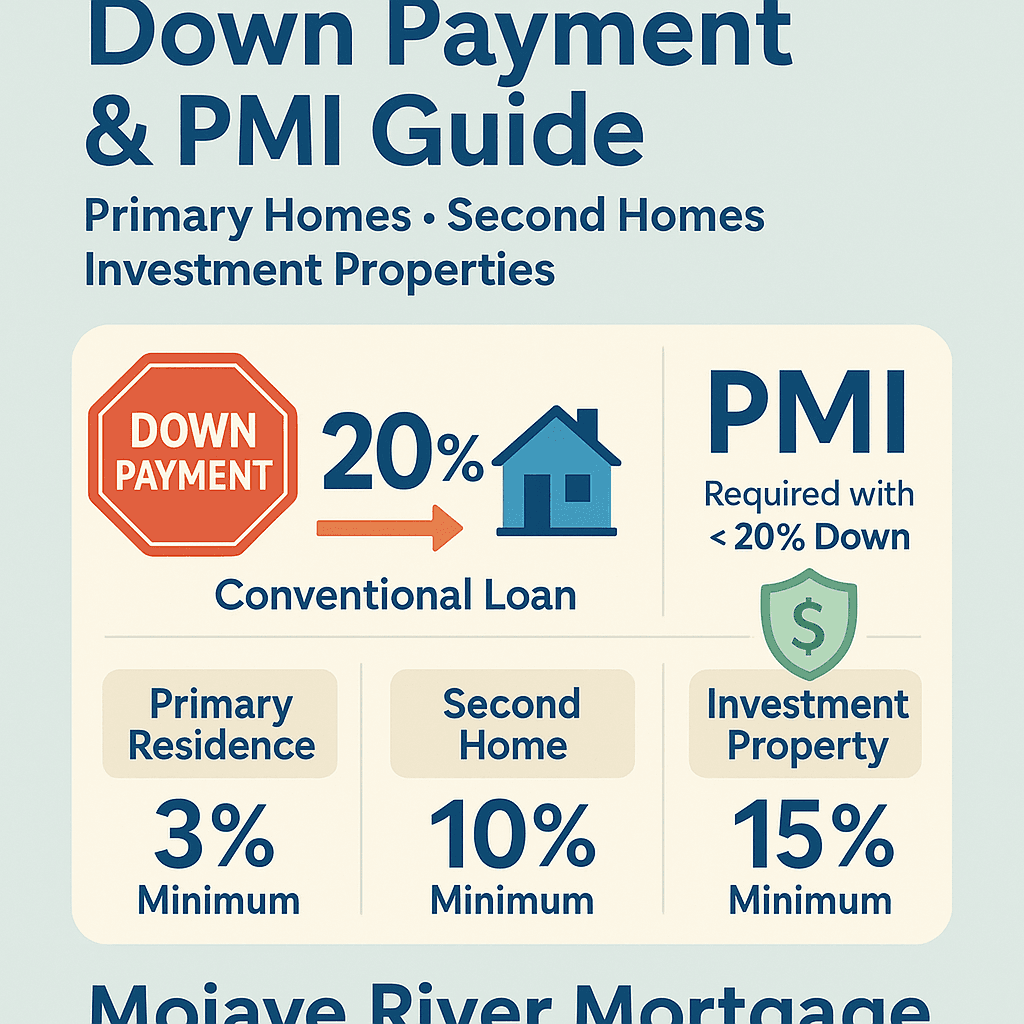

Down Payment Requirements & PMI Explained: How Much You Need for a Primary Home, Second Home, or Investment Property

Understanding down payment requirements and mortgage insurance can save homebuyers thousands. Here’s what to know about PMI rules for primary residences, second homes, and investment properties—plus strategies to avoid or reduce PMI when financing your next home.

Published on 12/09/2025

This Week in Mortgage Rates: Buyers Are Back as Rates Hover in the Low 6s

Mortgage rates bounced around but stayed in a tight range near the low 6% area this week, while purchase applications hit their highest level since early 2023 and refinance demand more than doubled compared to last year. Here’s what that means if you’re thinking about buying or refinancing.

Published on 12/06/2025

Why Home Loans from Mojave River Mortgage Are Faster, Easier & Cheaper Than The Competition

Mojave River Mortgage delivers faster, easier, and more affordable home loans than big banks or online lenders. With shorter escrow durations, stronger offer acceptance rates, and lower lock-period pricing, our clients close smoothly and save money. Learn how our refinance benefits also make us the top choice for homeowners looking to lower payments or tap equity.

Published on 12/04/2025