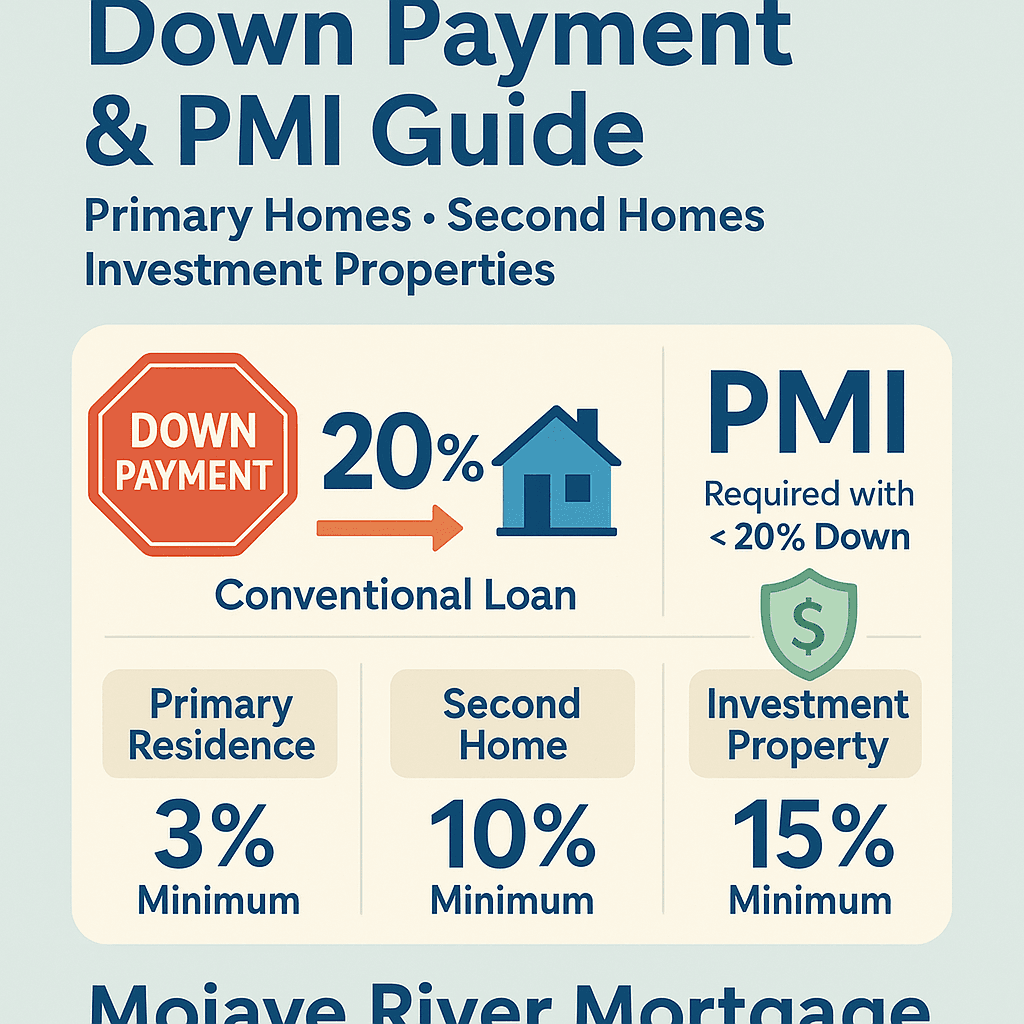

Down Payment Requirements & PMI Explained: How Much You Need for a Primary Home, Second Home, or Investment Property

Understanding down payment requirements and mortgage insurance can save homebuyers thousands. Here’s what to know about PMI rules for primary residences, second homes, and investment properties—plus strategies to avoid or reduce PMI when financing your next home.

If you’re preparing to buy a home, the most important (and often confusing) question is:

How much do I need for a down payment?

Whether you're purchasing a primary residence, a vacation home, or an investment property, each one has different down payment rules—and different PMI (private mortgage insurance) requirements.

At Mojave River Mortgage, we make this simple. Below is a clear breakdown of the down payment guidelines, when PMI applies, how PMI impacts your monthly payment, and how you can avoid or eliminate mortgage insurance faster.

1. Down Payment Requirements by Property Type

Different property types come with different risk levels for lenders, which is why the required down payment varies.

Primary Residence (Owner-Occupied)

These offer the lowest down payment options.

Conventional Loan Requirements:

Minimum down payment:3%–5%

PMI is required if you put less than 20% down

FHA Loan Requirements:

Minimum down payment:3.5%

Includes MIP (Mortgage Insurance Premium) instead of PMI

MIP may be permanent depending on loan type and LTV

VA Loans (for qualified veterans):

0% down

No PMI required (one of the biggest VA loan benefits)

USDA Loans:

0% down

Instead of PMI, there is a small annual “guarantee fee”

Primary homes give you access to the lowest down payments and the most PMI-avoidance strategies.

Second Homes (Vacation Homes)

Because these are not your primary residence, lenders require more skin in the game.

Conventional Loan Requirements:

Minimum down payment: 10%

PMI is required on loans with <20% down, but PMI rates on second homes are often slightly higher due to added risk

FHA, VA, and USDA loans cannot be used for second homes.

Investment Properties (Rentals, Long-Term or Short-Term)

Investment properties carry the highest risk for lenders, so the down payment is larger.

Conventional Loan Requirements:

Minimum down payment: 15% for 1-unit (with PMI)

20–25% down required to avoid PMI

Multi-unit properties: 25%+ down

Important: PMI can be applied to some 15%–20% down investor loans, but at much higher pricing than for primary residences.

There are no FHA, VA, or USDA financing options for investment properties.

2. When PMI Is Required

PMI (Private Mortgage Insurance) is generally required when you put less than 20% down on a conventional mortgage.

PMI applies to:

✔ Primary residences

✔ Second homes

✔ Investment properties (in limited cases)

PMI does not apply to:

✘ FHA loans (they use MIP instead)

✘ VA loans (no mortgage insurance at all)

✘ USDA loans (guarantee fee instead of PMI)

PMI protects the lender—not the homeowner—but it can be a useful tool to get into a home sooner without saving up 20%.

3. How PMI Impacts Your Monthly Payment

PMI usually costs between 0.3% and 1.5% of the loan amount per year, depending on:

Credit score

Down payment size

Property type

Occupancy (primary vs. second home vs. investment)

Loan term

Example:

A $500,000 loan with PMI at 0.6% annually = $3,000/year or $250/month added to the payment.

Investment properties may have higher PMI rates if PMI is allowed at all.

4. How to Avoid or Reduce PMI

There are several smart strategies to reduce PMI—or eliminate it entirely.

✅ Option 1: Put 20% Down

The simplest method, but not always possible or required.

✅ Option 2: Use a Piggyback 80/10/10 or 80/15/5 Loan

One of the best strategies we offer at Mojave River Mortgage.

How it works:

80% first mortgage

10–15% HELOC/second mortgage

5–10% down payment

No PMI because the first mortgage stays at 80% LTV

Works for:

✔ Primary residences

✔ Second homes (case-by-case)

✔ Some investment properties (limited availability)

✅ Option 3: Choose Lender-Paid Mortgage Insurance (LPMI)

The lender covers the cost of insurance in exchange for a slightly higher interest rate.

Good for borrowers with strong credit who want a lower monthly payment.

✅ Option 4: Refinance When Your Home Gains Equity

PMI can be removed once you reach 80% LTV, either through:

Paying down the loan

Increasing property value

Refinancing

✅ Option 5: FHA → Conventional Refinance

Since FHA MIP is often permanent, refinancing into a conventional loan can remove mortgage insurance entirely once equity is sufficient.

5. PMI Rules by Property Type (Quick Reference)

| Property Type | Minimum Down | PMI Required If | Can PMI Be Avoided? |

|---|---|---|---|

| Primary Residence | 3%–5% | <20% down | Yes, with 20% down or piggyback |

| Second Home | 10% | <20% down | Yes, with 20% down |

| Investment Property | 15%–25% | <20% down (limited availability) | Yes, with ≥20–25% down |

6. Which Strategy Is Best for You?

This depends on your goals:

✔ Low cash to close: 3% conventional or 3.5% FHA

✔ No monthly mortgage insurance: Piggyback 80/10/10 or VA loan

✔ Best rate: 20% down or conventional with single-premium PMI

✔ Purchase of investment property: 20–25% down is typically required

At Mojave River Mortgage, we specialize in helping borrowers compare down payment and PMI options to minimize costs and close fast.

Ready to Explore Your Best Down Payment Options?

Buying a home or investment property doesn’t have to be confusing. We’ll show you exactly how much you need down, whether PMI applies, and how to structure the loan for the lowest payment and best long-term savings.

Get a Same-Day Quote or Scenario Review

📞 Call or Text: (760) 713-6137

🌐 Apply Online: MojaveRiverMortgage.com

All loan guidelines, program requirements, down payment minimums, and PMI rules are subject to change without notice. This information has been reviewed for accuracy; however, it is not guaranteed to be complete, current, or error-free. Loan approval is not guaranteed and is based on the borrower’s credit, income, assets, and eligibility under current lending standards. For the most accurate and up-to-date information, please contact Mojave River Mortgage directly.