Recent Articles

Refinancing Isn’t Just About the Rate — It’s About Your Options

Learn what options refinancing makes available to you.

Published on 01/28/2026

Mortgage Rates at 3-Year Lows: Should You Refinance a 3% Mortgage?

The 3% Mortgage Give-Up Decision Calculator™

Published on 01/20/2026

BIG NEWS: Mortgage Rates Are at Their Lowest Level in Years—What That Means for You

Find out what this rate drop means to you for buying a new home.

Published on 01/19/2026

Lock-in Effect: Something big just happened in the U.S. Housing Market

Find out what the experts are anticipating for 2026 housing

Published on 01/12/2026

Holiday Week Catch-Up: Mortgage Rates Hover Near 2-Month Lows

A holiday-week catch-up: light trading kept markets mostly sideways, but the average 30-year fixed edged to near two-month lows as bonds got a small lift from Europe and pending home sales improved.

Published on 12/30/2025

Why Community Heroes Choose Mojave River Mortgage Over Big Banks

Mojave River Mortgage proudly offers home loans for heroes, helping teachers, first responders, healthcare workers, and veterans access special mortgage programs, including HUD’s Good Neighbor Next Door, hero-friendly conventional loans, and up to $1,000 in potential savings with free credit reports and reimbursed appraisals for eligible heroes.

Published on 12/18/2025

Home Loans for Heroes: Special Mortgage Programs & Savings for Community Heroes

Mojave River Mortgage proudly supports community heroes with special home loan options, including HUD’s Good Neighbor Next Door program and up to $1,000 in potential savings through free credit reports and reimbursed appraisals for eligible heroes.

Published on 12/18/2025

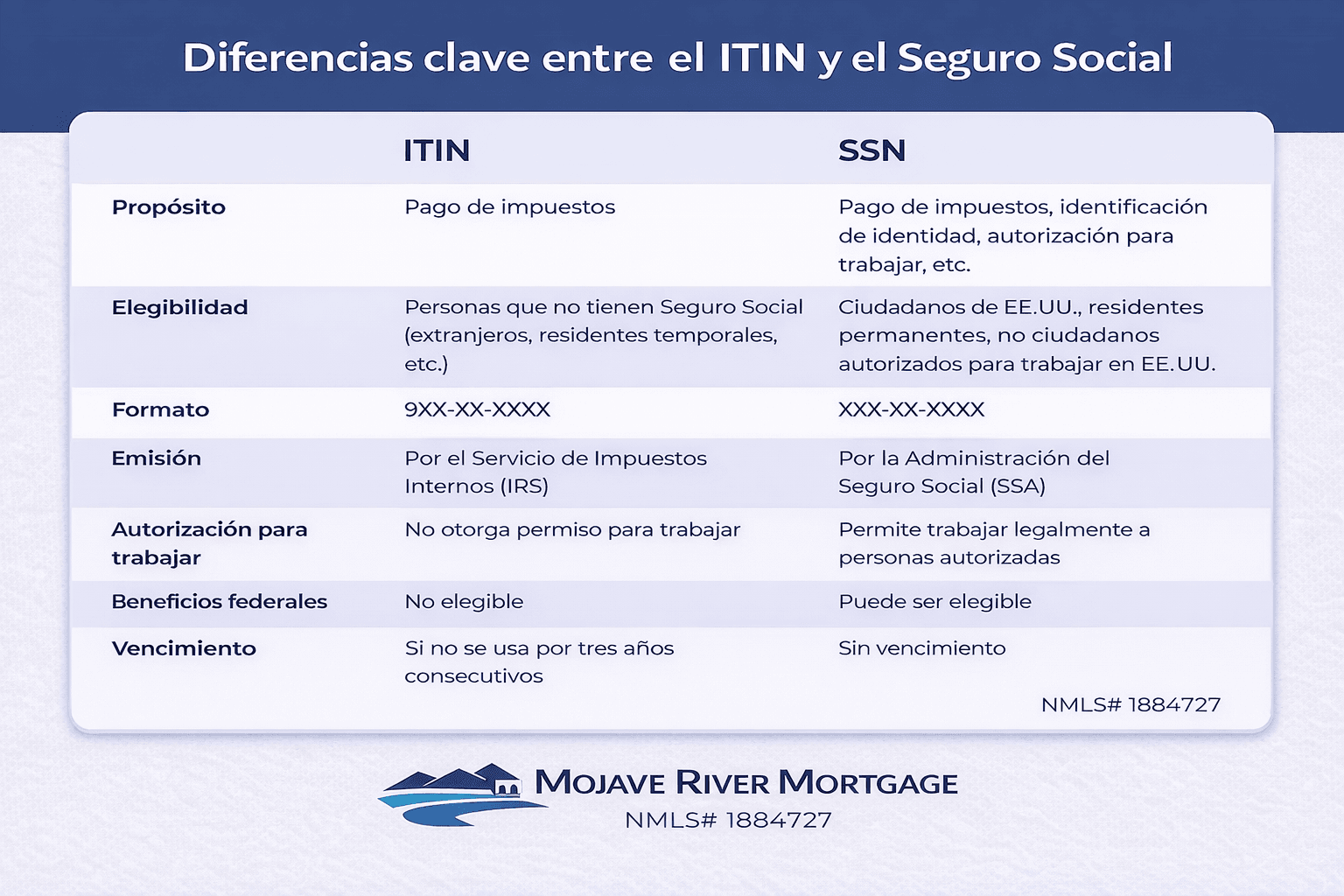

Préstamos Hipotecarios con ITIN en California: Cómo Mojave River Mortgage Ayuda a Comprar Casa Sin Número de Seguro Social

Mojave River Mortgage ofrece préstamos hipotecarios con ITIN para compradores de vivienda que no tienen número de Seguro Social. Descubra cómo funcionan, quién califica y quién se beneficia en California.

Published on 12/18/2025

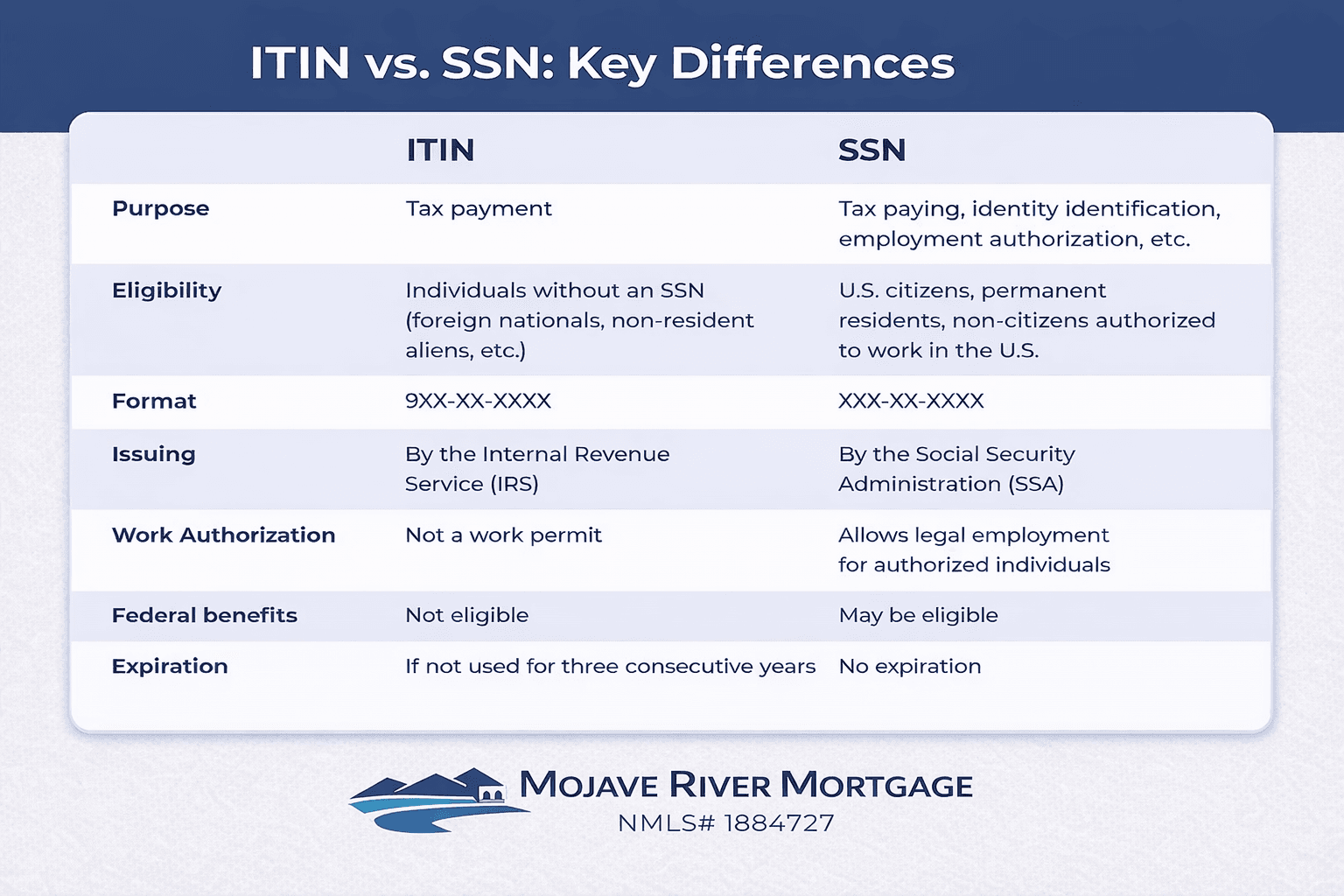

ITIN Home Loans in California: How Mojave River Mortgage Helps Non-Traditional Borrowers Buy Homes

Mojave River Mortgage offers ITIN home loans for qualified borrowers who do not have a Social Security number. Learn how ITIN mortgages work, who qualifies, and who benefits most from this flexible home-financing option in California.

Published on 12/18/2025