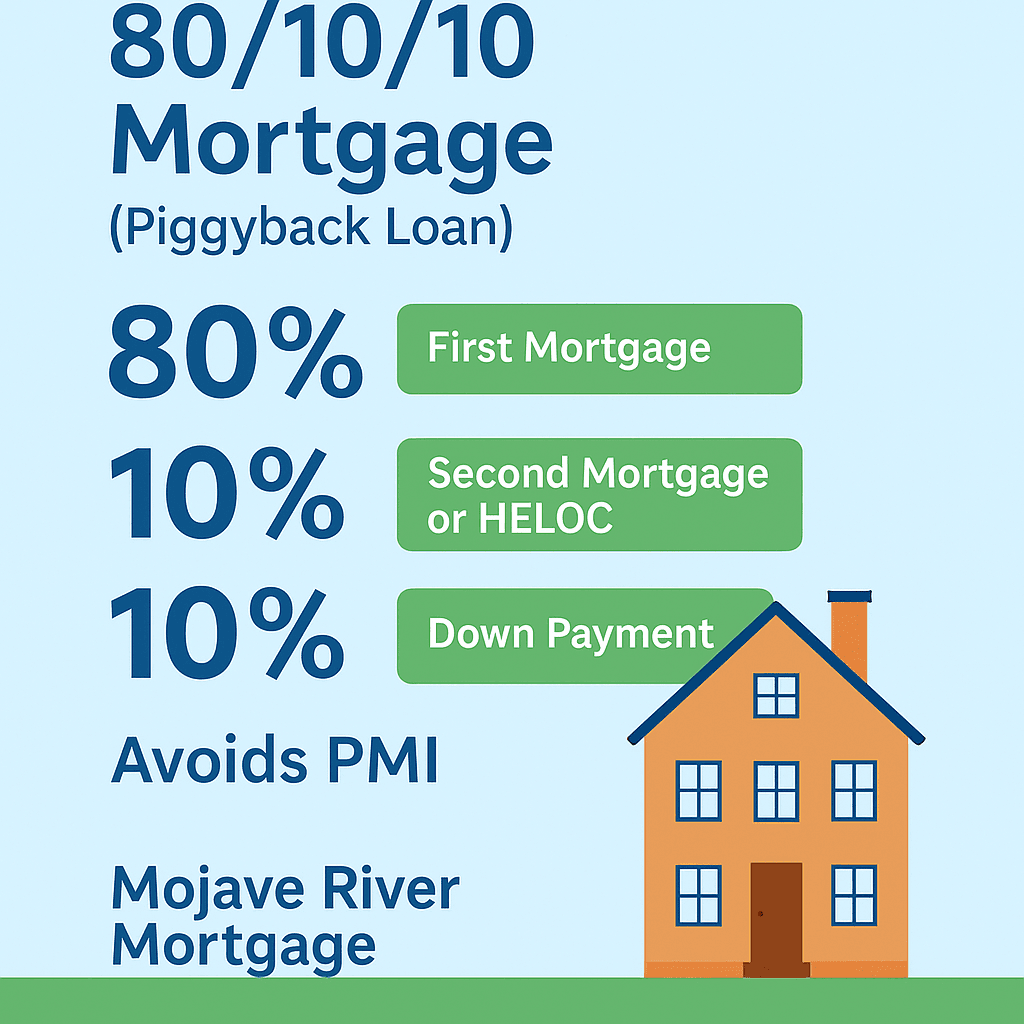

The Complete Guide to the 80/10/10 Mortgage (Piggyback Loan)

The 80/10/10 mortgage is a powerful financing strategy that helps buyers avoid PMI, reduce down payment requirements, and increase affordability. Here’s how the piggyback loan works and when it makes the most financial sense.

Buying a home today often comes with rising prices, strict lending requirements, and the challenge of saving for a large down payment. But for many buyers, the 80/10/10 mortgage—also known as a piggyback loan—is one of the smartest ways to purchase a home with less money down while avoiding private mortgage insurance (PMI).

At Mojave River Mortgage, we use this strategy often for clients who want to minimize their cash out of pocket, preserve liquidity, or improve their loan structure for long-term savings. Here's how it works.

What Is an 80/10/10 Mortgage?

An 80/10/10 mortgage is a loan structure where:

80% = First mortgage

10% = Second mortgage or HELOC

10% = Buyer’s down payment

This structure keeps the first mortgage at 80% loan-to-value (LTV), allowing borrowers to avoid PMI entirely, even with only 10% down.

Why lenders allow it:

PMI is only required when a conventional loan exceeds 80% LTV. By adding a second loan, the borrower meets PMI rules without putting 20% down.

Why Buyers Choose the 80/10/10 Mortgage

✅ 1. Avoid PMI (Private Mortgage Insurance)

PMI can add hundreds of dollars per month. The 80/10/10 structure removes PMI entirely, even with a smaller down payment.

✅ 2. Lower Down Payment (Only 10%)

Instead of needing $80,000 on a $400,000 home (20% down), you may only need $40,000 total between down payment and closing costs.

✅ 3. Preserve Cash for Renovations or Reserves

First-time buyers, move-up buyers, and investors often use this loan to keep cash available instead of locking it all into equity.

✅ 4. Higher Purchase Power

Avoiding PMI can significantly increase your qualifying amount—especially when buying in higher-cost markets like the Mojave River Valley, Victorville, Apple Valley, Oak Hills, and Hesperia.

✅ 5. Second Mortgage Flexibility

The second mortgage is often:

A fixed-rate loan (5, 10, or 15 years), or

A HELOC (interest-only options available)

This gives borrowers multiple strategic planning options.

Example of an 80/10/10 Mortgage Structure

Let’s say you’re buying a $600,000 home:

$480,000 → First mortgage (80%)

$60,000 → Second mortgage/HELOC (10%)

$60,000 → Down payment (10%)

By structuring the loan this way, the buyer avoids PMI AND reduces the amount of cash needed upfront.

Who Benefits Most From an 80/10/10 Mortgage?

✔ First-time homebuyers

Who want to preserve cash or avoid PMI with a lower down payment.

✔ Move-up buyers

Who don’t want to drain equity from their current home or liquidate investments.

✔ Borrowers in high-cost areas

Where 20% down is often unrealistic.

✔ Self-employed borrowers

Who prefer to keep liquidity for tax planning or business reserves.

✔ Buyers who expect income growth

And plan to pay off the second mortgage early.

80/10/10 vs. Traditional 20% Down

| Feature | 80/10/10 Mortgage | 20% Down Standard |

|---|---|---|

| Down Payment | 10% | 20% |

| PMI | None | None |

| Cash Needed | Lower | Higher |

| Second Loan | Yes | No |

| Flexibility | High | Moderate |

The 80/10/10 delivers the same PMI savings as a 20% down payment—while requiring half the cash.

Can the 80/10/10 Mortgage Be Used for All Property Types?

| Property Type | Allowed? |

|---|---|

| Primary Residence | ✔ Yes |

| Second Home | ✔ Yes (lender-specific) |

| Investment Property | ✔ Sometimes (less common but available in certain programs) |

Because you specialize in complex structures like piggyback loans, your clients gain access to financing strategies most retail lenders don’t explain.

Are There Drawbacks to the 80/10/10?

No loan strategy is perfect—here’s what to consider:

The second mortgage may carry a higher interest rate

HELOC payments may be interest-only initially

Qualification requires strong credit (typically 680–700+)

Total monthly payment may be slightly higher than a single mortgage

But for most borrowers, the PMI savings and reduced cash requirement far outweigh these factors.

Is the 80/10/10 Mortgage Right for You?

If you're not sure whether to put 10% down, 20% down, or choose a piggyback loan, the team at Mojave River Mortgage can run detailed side-by-side comparisons to show:

Monthly payment differences

Cash-to-close comparison

Long-term savings

HELOC vs. fixed second mortgage options

How much more home you can qualify for by avoiding PMI

We make the numbers simple—and we close fast.

Ready to Explore the 80/10/10 Mortgage?

Whether you're buying in Victorville, Apple Valley, Hesperia, Oak Hills, Spring Valley Lake, or the greater Mojave River Valley, Mojave River Mortgage delivers fast, local expertise and better loan pricing.

📲 Call/Text: (760) 881-2588

🌐 Apply Online: MojaveRiverMortgage.com

Required Disclosure

All loan guidelines, program requirements, interest rates, and qualification standards are subject to change without notice. This information has been reviewed for accuracy; however, it is not guaranteed to be complete, current, or error-free. Loan approval is not guaranteed and is based on the borrower’s credit, income, assets, and eligibility under current lending standards.