Recent Articles

Mortgage Rates Tick Up Slightly as Bonds Weaken and MBS Underperform

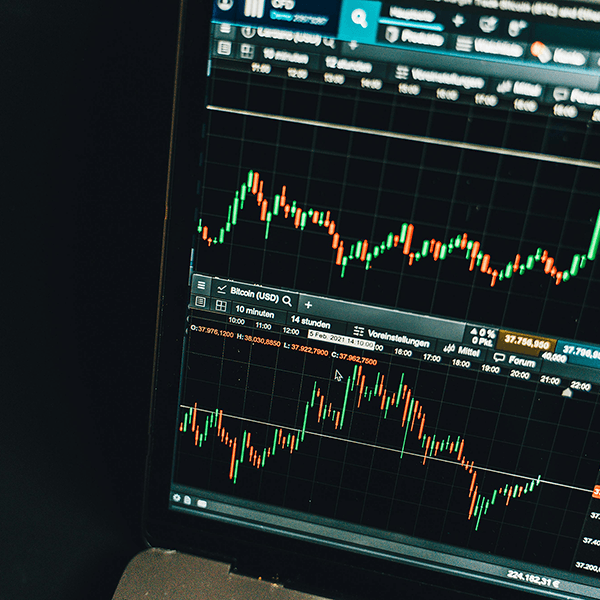

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Published on 10/10/2025

Mortgage Rates Holds Steady After Weak Jobs Report

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

3 Reasons Home Affordability Is Improving This Fall

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025

Mortgage Rates Hit Yearly Lows—Then Jump After the Fed Cut. Here’s What Happened (and Why Applications Just Surged)

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

Mortgage Rates Near 11 Month Lows—What’s Next With the Fed?

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

What Is a Piggyback Loan?

A piggyback loan pairs your first mortgage with a second (fixed home-equity loan or HELOC) so you can keep your first at 80%, avoid PMI, and bypass jumbo pricing—often with less cash due at closing. Here’s how it works, who benefits, and what to watch out for.

Published on 09/05/2025

Why Mortgage Rates Move: What Every Homebuyer Should Know

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

Mortgage Rates Holding Steady… For Now

After Powell's Jackson Hole speech, mortgage rates hit their lowest levels since Oct 2024. But don’t get too comfortable—more movement could be coming after Friday’s inflation data and next week's jobs report.

Published on 08/27/2025

Conventional One-Time Close Construction Loans: A Complete Guide

A Conventional One-Time Close (OTC) construction loan lets you finance your build and your permanent mortgage with a single closing. You’ll make interest-only payments during construction on the funds drawn, then the loan converts to a long-term fixed or ARM when the home is complete—no second closing. Benefits include one set of fees, extended rate-lock protection (often with float-down options), cancellable PMI above 80% LTV, and the ability to use existing lot equity toward your down payment. Get an appraisal “subject to completion,” approve your builder and plans, set a realistic draw schedule and contingency, and avoid change-order overruns. This guide covers eligibility, the step-by-step process, costs, PMI choices, and FAQs so you can decide if a conventional OTC is the right path for your new home.

Published on 08/21/2025