80-10-10 Mortgages vs. Low-Down-Payment Loans: Which Home Loan Is Right for You?

Looking to minimize mortgage insurance or buy with low money down? Mojave River Mortgage offers 80-10-10 piggyback loans, 97% conventional loans, and FHA financing. Compare options and find the right strategy for your home purchase or investment.

Flexible Home Loan Options at Mojave River Mortgage

At Mojave River Mortgage, we specialize in creative, flexible financing strategies for owner-occupied homes, second homes, and investment properties throughout the Mojave River Valley, Victorville, Apple Valley, Hesperia, and surrounding areas.

We proudly offer:

80-10-10 (Piggyback) Mortgages

95% Conventional Loans (5% down)

97% Conventional Loans (3% down)

FHA Loans (96.5% financing with 3.5% down)

Each option has unique advantages depending on your goals, credit profile, and cash position.

What Is an 80-10-10 Mortgage?

An 80-10-10 mortgage uses two loans instead of one:

80% first mortgage

10% second mortgage (HELOC or fixed second)

10% down payment

This structure keeps the first loan at 80% loan-to-value, helping borrowers avoid monthly PMI.

Available for:

Primary residences

Second homes

Investment properties (program availability and terms vary)

What Is a 97% Conventional Loan?

A 97% home loan allows buyers to purchase with just 3% down, using a single mortgage.

These loans are ideal for:

First-time buyers

Buyers who want to preserve cash

Owner-occupied properties

PMI is required but can often be removed once sufficient equity is reached.

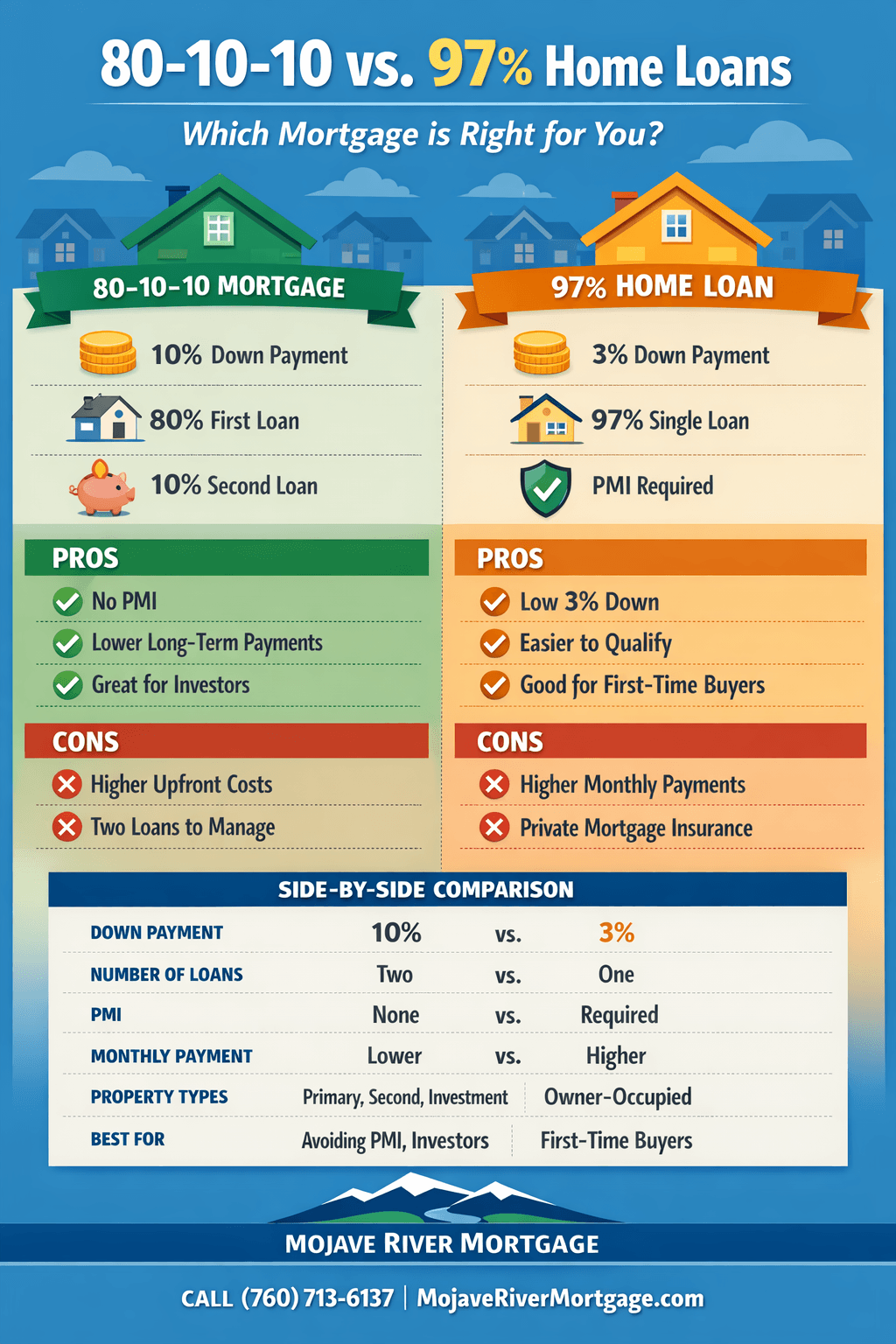

Side-by-Side Comparison: 80-10-10 vs. 97% (3% Down)

| Feature | 80-10-10 Mortgage | 97% Conventional (3% Down) |

|---|---|---|

| Down Payment | 10% | 3% |

| Number of Loans | Two | One |

| PMI | ❌ None | ✅ Required |

| Monthly Payment | Often lower long-term | Lower upfront, higher monthly |

| Interest Rates | First loan lower, second higher | Slightly higher due to PMI |

| Cash Needed | Higher upfront | Minimal upfront |

| Property Types | Primary, second, investment | Owner-occupied only |

| Best For | Avoiding PMI, investors | First-time & low-cash buyers |

What About 95% Conventional Loans (5% Down)?

A 95% conventional loan sits between these two options:

Requires 5% down

Single loan

PMI required (often less than a 97% loan)

Available for owner-occupied homes and sometimes second homes

This is a great compromise for buyers who want lower PMI than a 97% loan but don’t want the complexity of an 80-10-10 structure.

FHA Loans: Higher DTI Flexibility

FHA loans remain one of the most flexible options for buyers who:

Have higher debt-to-income ratios

Have limited credit history

Need underwriting flexibility

Key FHA highlights:

96.5% financing

3.5% down payment

Higher allowable DTIs than conventional loans

Upfront and monthly mortgage insurance required

Owner-occupied properties only

FHA can be a powerful stepping stone, especially when paired with a long-term refinance strategy.

Which Loan Is Right for You?

The best loan depends on:

Cash available

Credit profile

Income and DTI

Property type

Long-term investment strategy

At Mojave River Mortgage, we don’t push one loan—we help you strategically choose the right structure for today and tomorrow.

Work With a Local Mortgage Expert

Whether you’re buying a primary residence, second home, or investment property, Mojave River Mortgage offers:

Faster approvals

More flexible loan structures

Wholesale pricing advantages

Clear, strategy-based guidance

📍 Serving Victorville, Apple Valley, Hesperia, Oak Hills, and the Mojave River Valley

📞 Call or text (760) 713-6137

🌐 www.MojaveRiverMortgage.com