ITIN Home Loans in California: How Mojave River Mortgage Helps Non-Traditional Borrowers Buy Homes

Mojave River Mortgage offers ITIN home loans for qualified borrowers who do not have a Social Security number. Learn how ITIN mortgages work, who qualifies, and who benefits most from this flexible home-financing option in California.

What Is an ITIN Home Loan?

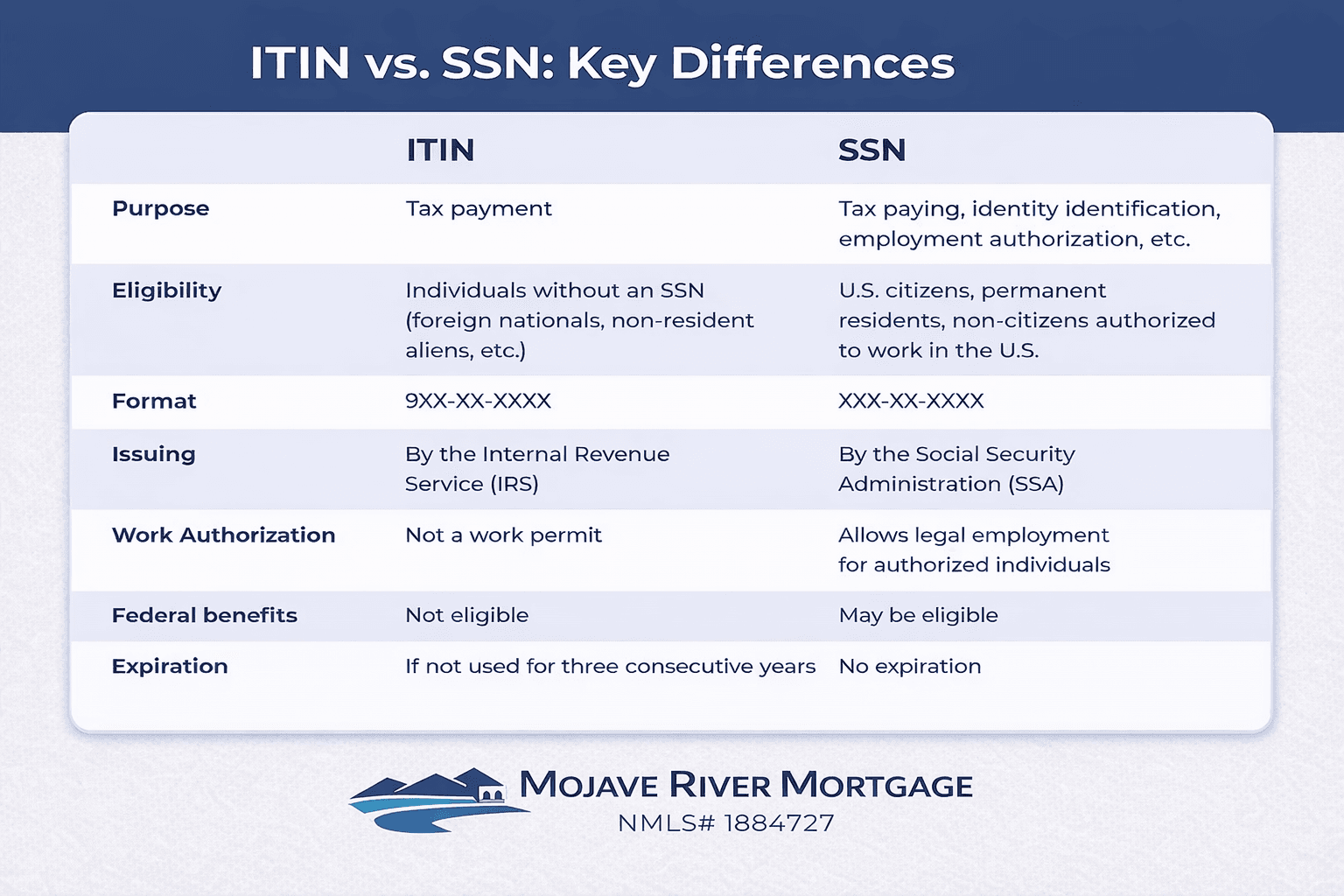

An ITIN home loan is a mortgage designed for borrowers who do not have a Social Security number, but who instead file U.S. taxes using an Individual Taxpayer Identification Number (ITIN) issued by the IRS.

At Mojave River Mortgage, we work with wholesale lenders that offer ITIN mortgage programs for:

Primary residences

Second homes

Investment properties

These loans make homeownership possible for hardworking individuals and families who contribute to the U.S. economy and pay taxes, but don’t fit into traditional mortgage guidelines.

Who Benefits from an ITIN Loan?

ITIN loans are ideal for borrowers who are financially responsible but excluded from conventional lending programs.

1. Non-U.S. Citizens Who Pay U.S. Taxes

Many borrowers legally work and pay taxes using an ITIN but cannot qualify for FHA, VA, or conventional loans. ITIN mortgages provide a clear path to homeownership without a Social Security number.

2. Self-Employed & Entrepreneurial Borrowers

ITIN loan programs often allow:

Bank statement qualification

Alternative income documentation

Flexible underwriting

This is especially helpful for business owners, contractors, and cash-flow-based earners.

3. Real Estate Investors

Some ITIN loan programs allow:

Investment property purchases

Multiple financed properties

Rental income consideration

This opens doors for long-term wealth building through real estate.

4. Families Seeking Stability

Homeownership provides:

Housing security

Fixed monthly payments

Long-term equity growth

ITIN loans allow families to put down roots instead of continuing to rent.

What Are the Typical ITIN Loan Requirements?

While requirements vary by lender, many ITIN mortgage programs include:

Valid ITIN issued by the IRS

Two years of tax returns filed with an ITIN

Verifiable income (W-2s, 1099s, or bank statements)

Down payment (often higher than conventional loans)

Proof of residency and identity

Satisfactory credit history (traditional or alternative credit accepted in some cases)

💡 ITIN loans are not government-insured, but they are fully legal, widely used, and increasingly common in California.

Why Work with Mojave River Mortgage for an ITIN Loan?

At Mojave River Mortgage, we specialize in non-QM and alternative lending solutions, including ITIN mortgages. Our advantages include:

Access to multiple wholesale ITIN lenders

Competitive rates and flexible terms

Experience with complex income scenarios

Local expertise in the Mojave River Valley, including Victorville, Apple Valley, Hesperia, and Oak Hills

Personalized guidance from application to closing

We take the time to structure loans correctly the first time—saving you time, stress, and money.

Can You Buy a Home Without a Social Security Number?

Yes. If you have an ITIN and meet lender guidelines, homeownership may be closer than you think.

Whether you’re buying your first home, a second home, or an investment property, Mojave River Mortgage can help you explore your ITIN loan options with confidence.

Start Your ITIN Loan Consultation Today

📞 Call or Text: (760) 713-6137

🌐 Apply Online:https://MojaveRiverMortgage.com

Mojave River Mortgage — Expanding access to homeownership through smarter lending solutions.